Are the Insurance stocks on the rebound now?

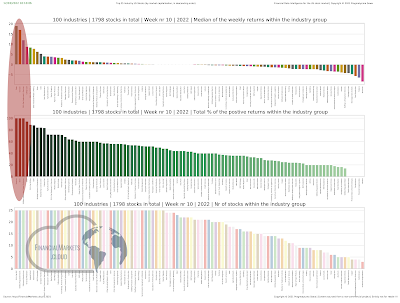

Week 12 2022 Scanner Kolejarz spotted the unusual volatility on the following Insurance stocks: PZU.WAR | Powszechny Zaklad Ubezpieczen S A | GPW/ WSE AEG , Aegon N V | NYSE MET , MetLife Inc | NYSE That is positively correlated with the data from the " Sky is the limit " project which shows 17 stocks from the Insurance sector/industry that beats its All Time High (ATH) this week. Moreover, MET | MetLife Inc | The New York Stock Exchange is on its ATH this week (71.29) Previous All time high date: 2022-02-11 | Previous ath: 71.03 | This week ATH: 71.29 ATH data by courtesy of the Sky is the limit project. News and observations in this article were extrapolated from publicly available data, and subsequently processed by the FinancialMarkets.cloud system powered by Artificial Intelligence. *** Disclaimer Please note that the content of this article is not investment advice. Please do your own research, and ideally backtest before trade. Before making any financial