Week 34 | 2022 | US Stock Market | is it fading optimism or fear under control?

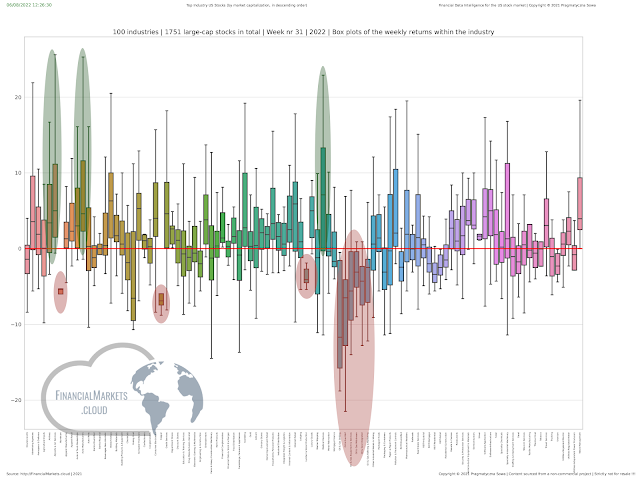

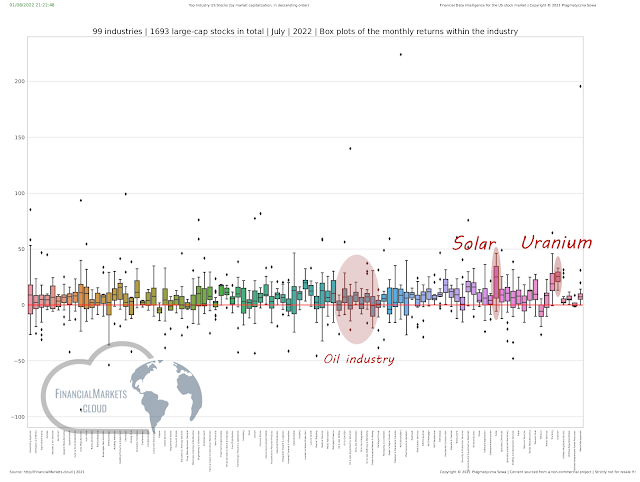

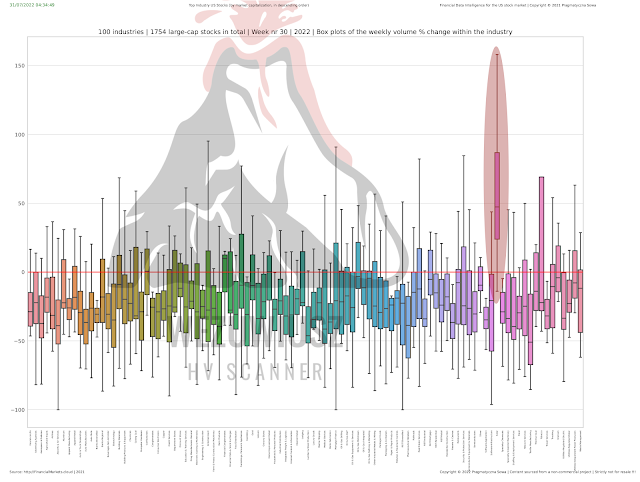

Commodities (Aluminum, Copper, Silver) and energy (Oil & Uranium) stocks withstood the fading optimism during the entire 34th week of 2022. Market uncertainty | VIX overview | Week 34 All VIX indices were higher and crossed (or touched) their 3 week moving average. CBOE Gold Volatitity CBOE NASDAQ 100 Volatility CBOE S&P 500 3 Month Volatility CBOE Volatility Index Cboe Russell 2000 Volatility Index STOXX 50 Volatility VSTOXX EUR S&P 500 VIX Futures Some of them crossed their 12 MA as well: CBOE Brazil Etf Volatility CBOE Crude Oil Volatility CBOE Euro Currency Volatility News pick from the last week (collected by RadioSowa.pl) | week 34 https://www.reuters.com/article/usa-economy-housing/u-s-new-home-sales-plunge-in-july-amid-higher-mortgage-rates-idUSL1N2ZY1I5#:~:text=WASHINGTON%20(Reuters)%20%2D%20Sales%20of,Commerce%20Department%20said%20on%20Tuesday. https://www.cnn.com/2022/08/23/homes/new-home-sales-july/index.html https://www.reuters.com/markets/europe/us-pend