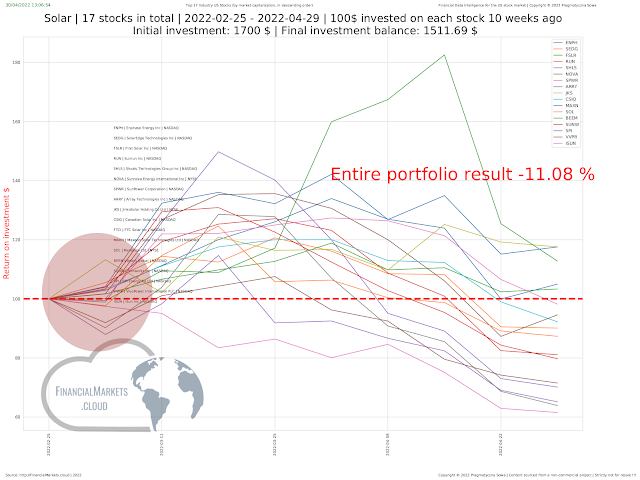

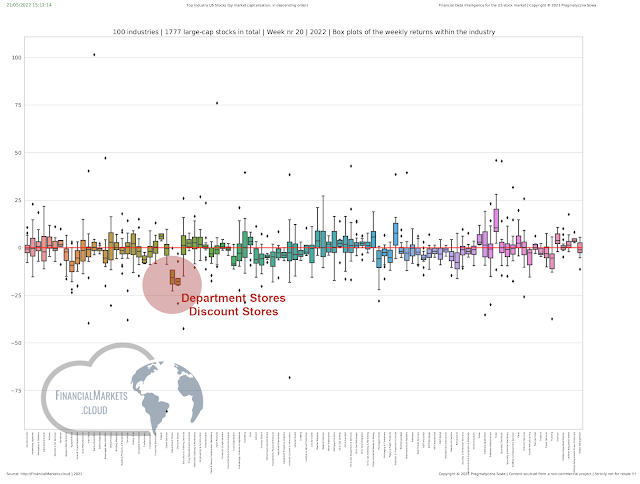

Week 20 | 2022 | US retailers / staples stocks hit hard by inflationary consumer behaviour and supply chain issues.

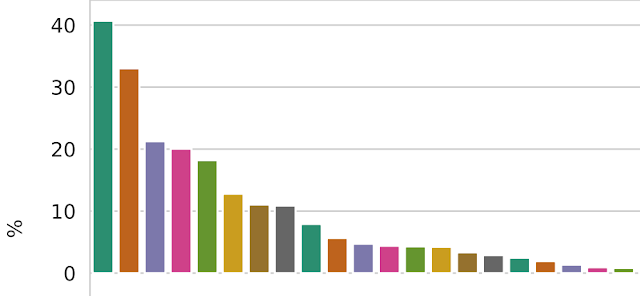

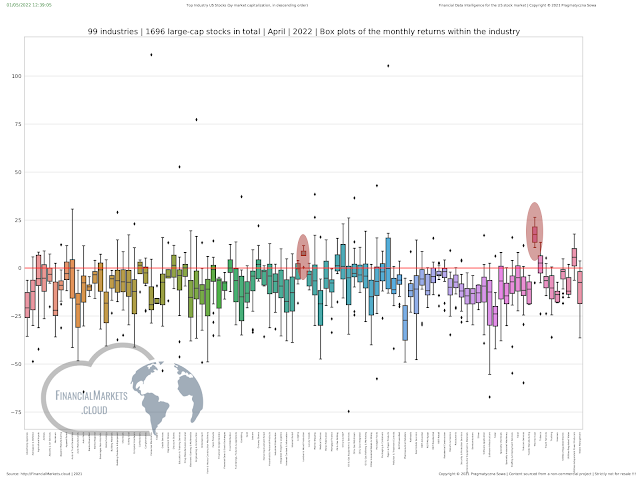

#week20 2022: Steep slope seen on the industry stock portfolios associated with consumer staples stocks. AI also spots sudden change on the consumer staples stocks this week: Confectioners, Discount & Department Stores far away from the group. Unusual volatility seen by Scanner Kolejarz [Relevant News / Sources] [1] #CNBC #CNBCTV | The 'Halftime Report' investment committee weighs in on staples stocks [2] https://www.fool.com/investing/2022/05/19/why-dollar-general-dropped-this-week/ [3] https://www.fool.com/investing/2022/05/20/why-target-costco-and-kohls-stocks-got-pummeled/ [4] "Last week, consumer staples dived 8.6% and consumer discretionary tumbled 7.4%, the biggest declines of any S&P 500 sectors, with inflation hammering corporate results. Shares of some companies fared far worse, with Walmart swooning 19.5% for the week and Target plunging 29% after disappointing results" https://money.usnews.com/investing/news/articles/2022-05-23/analysis-beaten-d