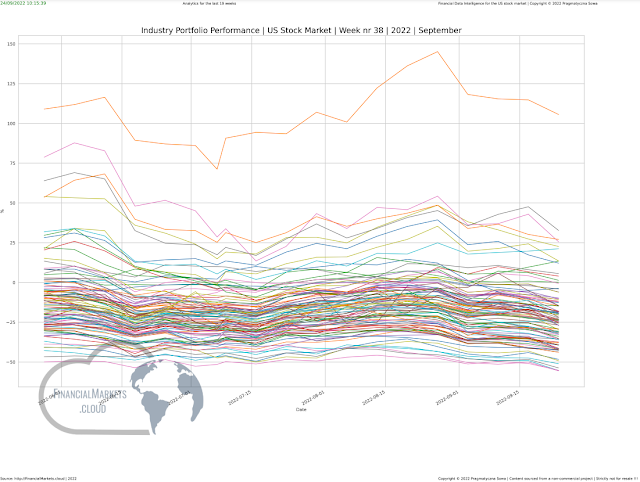

Top industry stock portfolios that earned the most in the last 42 weeks | Week 38 | 2022 | The US Stock Market

What earned the most in almost a recent year? The results are explicit. Far from the news & investors media one industry stock portfolio in silence went above 140% four weeks ago (since then is continuously declining). An above figure shows that there is only one leader and a few others that are chasing his tail. Nevertheless, the majority resides below zero, some of them far below it. This analysis takes into consideration only the industry stocks portfolios comprised of the large-cap stocks with the highest market-cap. For the purpose of this comparison, this investment started 42 weeks ago with 100$ put on each. Since then, each portfolio result was tracked on the weekly basis. Overall, as of the week 38 (2022) only 13 industry portfolios (out of 100) ended up with a positive return. The detailed portfolio analytics will be provided only for the top 5. #13 Banks-Regional +0,11% #12 Agricultural Inputs +1,38% #11 Copper +4,03% #10 Utilities-Regulated Electric +5,63% #9