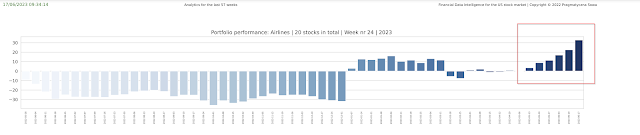

Summer holidays impact on Travel Services and Airlines stocks | Week 24 | 2023

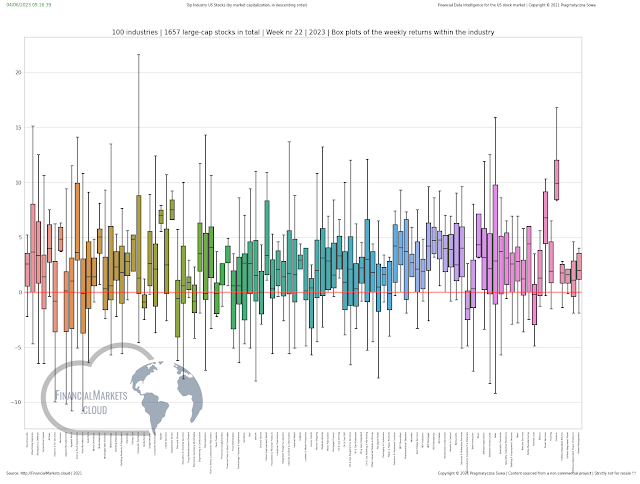

Travel Services and Airlines stocks are getting stronger since several weeks. Undoubtedly, The Summer Holidays are behind the rapid upward move. Relevant Stock News: https://www.fool.com/investing/2023/06/14/carnival-booking-holdings-norwegian-cruise-buys/ Data sources : EOD Data| https://eodhistoricaldata.com / Data Analytics sources: Cloud analytics | US Stocks FinancialMarkets.cloud Skaner ponad-przecięntej zmienności rynkowej: Skaner Kolejarz Suggested citation: Summer holidays impact on Travel Services and Airlines stocks | Week 24 | 2023 https://www.financialdata.news/2023/06/summer-holidays-impact-on-travel.html Written by 'Kolejarz' from the MarketGeeks.pl team. ------------------------------------------------------------------------------------------------------------------------------------------------------ *** Disclaimer Please note that the content of this article is not an investment advice. Please do your own research, and ideally backtest befor